In human history, money has always been an important aspect of life. It has seen a lot of changes with the time from the barter system in early civilization, then gold & silver coins to paper money, there have been major changes. But now the money is not limited to a hard copy. With the advent of digitization, it is now available in the digital form also.

Digital money has resolved a lot of problems associated with physical money and has paved the way of numerous payment methods and technologies for a better payment experience. E-wallets are one such trend of digital money.

In the last 5 years, e-wallets have become the favourite medium of payment for both in-store as well as for digital purchases. They aren’t limited to just storing your money but are getting used for many different purposes.

Each year we see new technologies being introduced in the wallet apps that make it more advanced. In this article, we are going to discuss those trends with their benefits. Let’s first we should know more about e-wallets beginning with types of e-wallets.

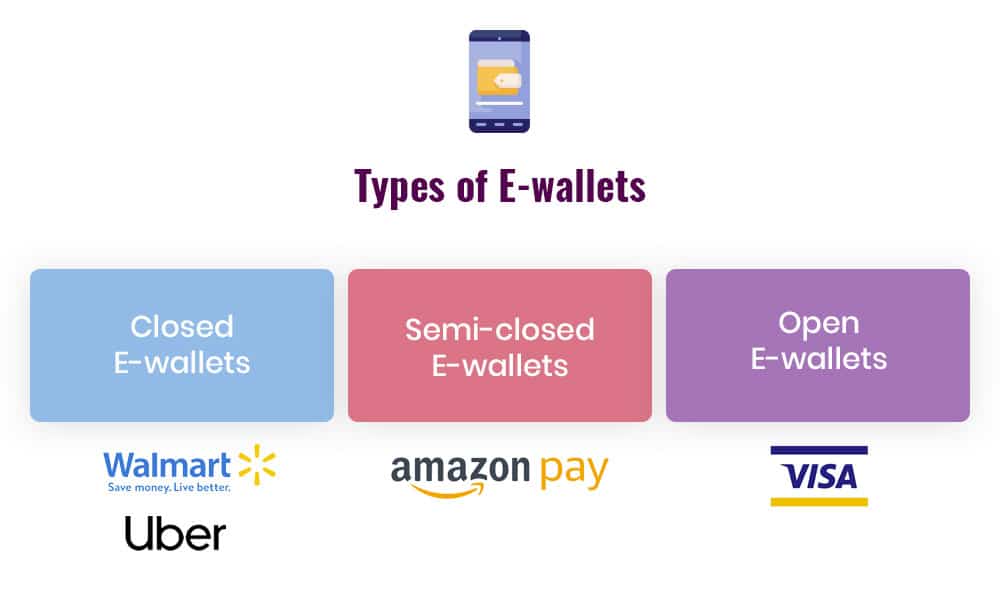

Types of E-wallets

There are 3 major categories in which the e-wallets are divided.

Closed E-wallets

In closed e-wallets, the payments can be done to only the wallet issues. The major examples are Walmart, Uber Cash etc.

Semi-closed E-wallets

You can pay to the allowed merchants by the semi-closed e-wallets. The best example is Amazon pay. Both Closed and Semi-closed e-wallets don’t allow cash withdrawal.

Open E-wallets

In addition to closed and semi-closed e-wallet services, it also allows users to withdraw money via ATMs or Banking correspondents.

Read more: 10 Useful Tips From Experts For Mobile App Development Services

Here are the top three digital wallet trends that will dominate the year of 2021

Smart Voice Payments

Smart speakers or home voice assistants have seen massive growth in recent years. They can talk to the customers like a human being and resolve their queries. They are able to receive commands and receive the responses of human voices. You can ask them about the recent news, weather updates, booking a cab, or any other update.

IT giants such as Apple, Google, and Amazon have been in this smart speaker race. Amazon was the first one to lead this race by introducing its smart speaker Amazon Alexa way back in 2014. While Google joined this race in 2016 by introducing Google Home, Apple was the last but not least to come up with its smart speaker in 2017. These smart speakers were able to seek information, playing music or streaming videos, accessing customer services, buying products, ordering a meal, controlling smart home devices. But now they aren’t limited to these services, now these smart speakers can be used for sending money or making a payment. However, the proportion of using smart speakers for making payments is quite less due to security reasons.

And that’s the reason why we see big names like Google, Amazon, and Apple investing heavily to be the first to come up with an advanced smart speaker solution.

Sound waves-based payments

You must have not heard of this technology. This is comparatively a new technology by which you can make payments without any internet connection. There are many digital wallet companies which are seeking this technology due to its convenience, and ease. The payments or transactions are processed through sound waves that carry the encrypted data of the payment. The mobile phone converts the data into an analogue signal which precedes the payment. Unlike NFC, which uses the inbuilt technology, in sound waves, you just need simple software installation.

Near-field Communication (NFC) payments

NFC payments have seen massive growth in the UK. The contactless card transactions were 14 million five years ago, and now the number of users have become 644 million in 2019. The best examples of contactless digital wallets are Google Pay, Samsung Pay, and Apple pay.

This NFC technology is quite better than the traditional PIN technology as it can transfer the encrypted data to the point-of-sale service. On the other side, PIN takes more time. It has been predicted that by 2027, 36% of all payment would be done by contactless cards.

Challenges

While there are a lot of pros associated with the e-wallets, you can’t just skip the challenges linked with them. These are:

Regulatory Compliance

When you deal with money, the companies need to follow strict compliances and all the legal regulations. The compliances include both the financial and consumer-based regulations.

Fraud Risk

Risk of fraud is one of the most common reasons for non-techie people to avoid electronic transactions. The people who are not so aware of their methodology are also unbeknownst to hacking, data theft/leak, vulnerabilities, and malware. Hence, while developing an e-wallet application you should make it compliant with PCI and DSS.

Customer Mindset

There are many customers who still don’t find any additional service while using e-wallets. The reason can be anything fraud risk, or not knowing the perks of using e-wallets. Due to this reason, many companies have also provided several discounts, and cashback offers for creating awareness and enticing them to use these e-wallets.

Lack of Trust

As per research, nearly 43% of mobile users found trust issues while using e-wallets. One-third believe that if their phone got stolen or lost, then some other person can use the money which is in their accounts. However, all the digital wallet companies are coming up with many advantageous solutions and better security features for all scenarios.

Read more: Top Myths about Full Stack Application Developers & Test Questions

Wrapping Up

As you have understood the bright future of e-wallets along with their challenges and trends. It is time that you should share your idea with an expert mobile app development company that can come up with the right e-wallet solution for your mobile application. We, at Amplework, have expertise in developing advanced level e-commerce mobile applications with digital wallets suiting your requirements. Just tell us your requirements and we will come up with the best solution.