AI in Wealth Management: Transforming Financial Planning and Investment Approaches

Introduction

AI in wealth management is transforming how financial advisors serve clients, making sophisticated investment strategies accessible and delivering personalized guidance at scale. Historically labor-intensive, the industry now leverages AI to serve more clients efficiently, reduce costs, and improve outcomes.

This guide explores practical AI use cases, real-world examples, and how leading firms enhance client experiences, optimize portfolios, and maintain a competitive edge in an increasingly automated financial landscape.

The AI Revolution in Wealth Management

The wealth management industry faces pressure: clients demand personalized service, regulatory requirements increase complexity, fee compression reduces margins, and next-generation investors expect digital-first experiences. AI in wealth management addresses these challenges by augmenting human advisors with capabilities handling routine tasks, analyze vast datasets, and deliver insights impossible through manual analysis.

Market Impact: The AI wealth management market is projected to reach $6.9 billion by 2030, with adoption accelerating as firms recognize the competitive advantages AI delivers, 30-50% operational cost reductions, 40-60% improvements in client engagement, and portfolio performance enhancements of 15-25%.

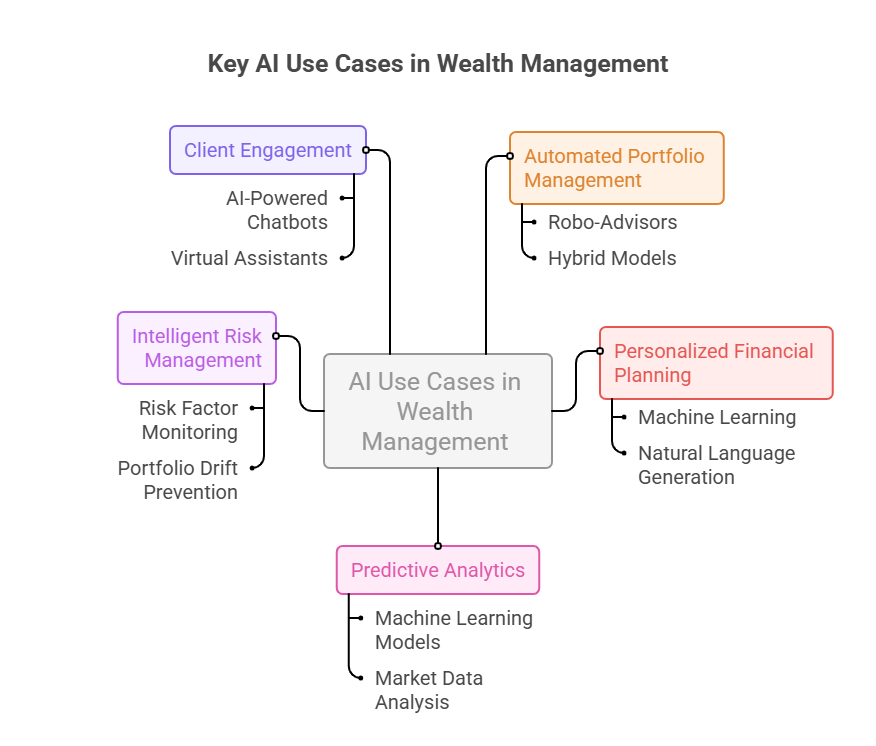

Key AI Use Cases in Wealth Management

1. Automated Portfolio Management and Robo-Advisors

Application: AI-powered platforms analyze client risk profiles, financial goals, and market conditions to construct, rebalance, and optimize investment portfolios automatically.

How It Works: Algorithms assess thousands of investment options, correlations, and risk factors in real-time, making allocation decisions balancing growth objectives with risk tolerance. Automated rebalancing maintains target allocations as markets fluctuate.

Impact: Robo-advisors manage over $1.4 trillion globally, offering professional-grade portfolio management at 0.25-0.50% fees versus 1-2% for traditional advisors. Betterment and Wealthfront serve millions of clients, impossible to reach with human-only models.

Hybrid Models: Leading firms combine AI automation with human advisors, AI handles routine portfolio management while advisors focus on complex planning, relationship building, and life event guidance.

2. Personalized Financial Planning

Application: AI financial planning analyzes comprehensive client data, income, expenses, assets, liabilities, goals, generating customized financial plans addressing retirement, education funding, tax optimization, and estate planning.

How It Works: Machine learning models process client financial situations, comparing against thousands of similar profiles to identify optimal strategies. Natural language generation creates human-readable reports explaining recommendations and trade-offs.

Impact: What traditionally required 10-15 hours of advisor time completes in minutes, enabling advisors to serve 2-3x more clients while improving plan comprehensiveness and accuracy.

3. Predictive Analytics and Market Intelligence

Application: AI analyzes vast datasets, market data, economic indicators, news sentiment, and alternative data, identifying patterns and opportunities that human analysts miss.

How It Works: Machine learning models process structured data (prices, volumes) and unstructured data (news, earnings calls, social media), generating investment insights, risk signals, and market forecasts.

Impact: AI-enhanced strategies identify emerging trends earlier, anticipate market shifts, and uncover undervalued opportunities. Hedge funds using AI report 20-40% performance improvements over traditional approaches.

4. Intelligent Risk Management

Application: AI continuously monitors portfolios, market conditions, and client circumstances, detecting risks requiring attention, concentration risk, correlation changes, liquidity issues, or life events affecting financial plans.

How It Works: Algorithms track hundreds of risk factors simultaneously, alerting advisors when portfolios deviate from acceptable parameters or when market conditions threaten client objectives.

Impact: Proactive risk management prevents losses, maintains portfolio alignment with client risk tolerance, and enables rapid response to market disruptions. Firms report a 30-50% reduction in portfolio drift and faster risk mitigation.

5. Client Engagement and Relationship Management

Application: AI-powered chatbots and virtual assistants provide 24/7 client support, answering questions, providing account information, and handling routine requests without human intervention.

How It Works: Natural language processing understands client inquiries, retrieves relevant information from databases, and generates contextually appropriate responses. Complex queries escalate to human advisors seamlessly.

Impact: Client satisfaction increases 25-40% with instant access to information. Advisors focus on high-value interactions while AI handles 60-70% of routine inquiries.

Real-World AI in Wealth Management Examples

Morgan Stanley: Deployed an AI assistant analyzing research reports, suggesting investment ideas, and automating administrative tasks for 16,000 advisors. Result: 15-20% productivity increase and enhanced client service quality.

BlackRock: Leverages the Aladdin AI platform, processing millions of data points daily, providing risk analytics, portfolio optimization, and scenario analysis for $21.6 trillion in assets.

JPMorgan Chase: Uses COIN AI analyzing legal documents, COIN processing 12,000 annual commercial credit agreements in seconds versus 360,000 hours of manual review previously.

Vanguard Personal Advisor Services: Hybrid model combining AI-powered portfolio management with human advisors serving clients with as little as $50,000, previously requiring a $1 million minimum. Manages $230+ billion assets.

Wealthfront: Pioneered automated tax-loss harvesting using AI algorithms, identifying tax-saving opportunities daily. Clients save an average of 1.5-2% annually on taxes, often exceeding management fees.

Also Read : AI in Finance: Automate Financial Reports to Save Time & Drive Growth

Benefits of AI in Wealth Management

- Democratization of Wealth Management: AI makes sophisticated strategies accessible to mass affluent clients, not just ultra-high-net-worth individuals. Millions now access services previously exclusive to the wealthy.

- Enhanced Personalization: AI analyzes individual circumstances, delivering truly personalized recommendations versus one-size-fits-all strategies.

- 24/7 Availability: Clients access information and receive guidance anytime without waiting for the advisor’s availability.

- Reduced Costs: Automation drives 30-50% cost reductions, enabling lower fees, making wealth management profitable for smaller accounts.

- Improved Outcomes: Data-driven decisions, disciplined rebalancing, and tax optimization typically improve portfolio performance 15-25% over purely manual approaches.

Challenges and Considerations

- Trust and Transparency: Clients must trust AI recommendations. Explainable AI showing reasoning behind suggestions builds confidence.

- Regulatory Compliance: Wealth management faces strict regulations. AI systems must maintain compliance, document decisions, and pass audits.

- Data Security: Protecting sensitive financial information is paramount. Robust cybersecurity and encryption are non-negotiable.

- Human Touch: Complex situations, inheritance, and business sales require human empathy and judgment that AI cannot replicate. Successful models balance automation with human expertise.

Also Read : Optimizing Financial Risk Analysis with AI Agents: Development Strategies and Tools

Conclusion

AI is transforming wealth management by enabling personalized, data-driven advice at scale. Automated portfolios, predictive analytics, and intelligent risk monitoring help firms serve more clients efficiently while improving outcomes and competitiveness.

Amplework delivers tailored AI solutions for wealth management, combining technical expertise, secure deployment, and scalable systems. Firms gain actionable insights, robust data protection, and enhanced client trust while maintaining regulatory compliance and operational efficiency.

sales@amplework.com

sales@amplework.com

(+91) 9636-962-228

(+91) 9636-962-228