There was a time when an individual could easily borrow money from the bank but now there is so much red-tapism or bureaucracy that even proving your collateral or assets is a big task. You have to make unnecessary grounds, stand in a queue and have to suffer many other hassles, but still, you will probably don’t get the loan. But with the new mobile technology and applications, you can instantly get a loan by a P2P loan lending mobile application. In this article, we are going to cover all the aspects of P2P mobile app development.

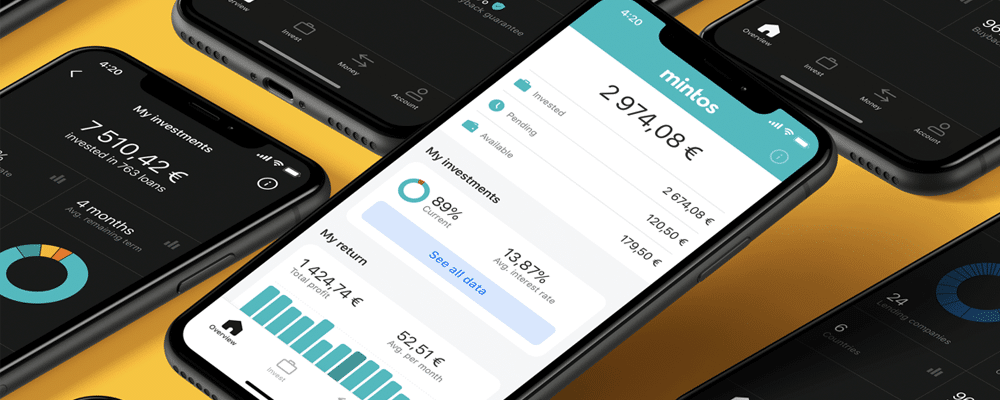

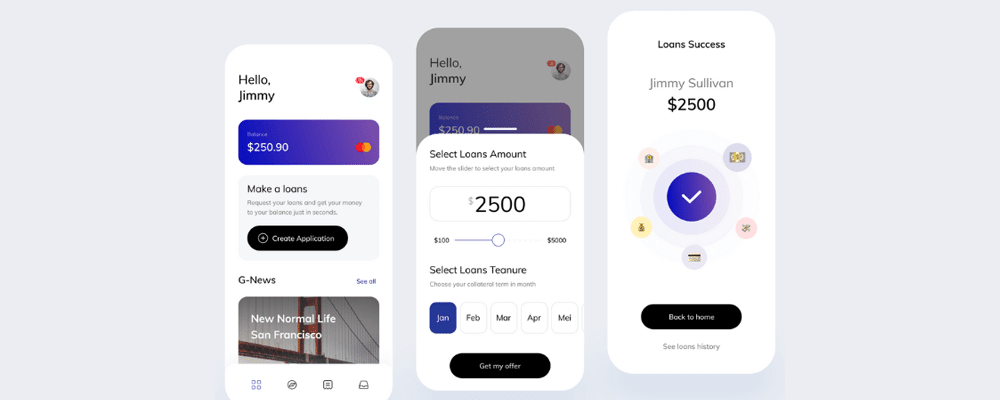

P2P Loan Lending App

On a P2P loan lending mobile application, the borrowers and money lenders are similar parties such as companies or individuals. There is no involvement of intermediates such as brokers, commission agents, banks, or any other financial institution. Due to this, the loan rate is not that much higher and investors also gain a good profit.

The complete process of lending money, borrowing and returning the loan amount takes place on a mobile application where the user entities are both money lenders and borrowers.

In the traditional banking process, there are several expenses included such as rent, office staff fees, computers, etc. while P2P loan lending app there is no such requirement. You just need an expert mobile application development company who is having expertise in developing custom apps.

Working of a P2P Loan Lending App

For Borrowers

Sign Up: The borrower will Sign-up in the app and will submit his financial information. The financial account should be at least a year old. The borrower also may need to describe his business to get assurance from lenders.

Crediting: After completing the Sign-up the money lenders will get to know about your credibility. The admin will let them know about the risks and rewards of lending money.

Loan Market: There is a loan market where your loan will go live. The lenders will bid on your loan, and the least interest rate bid would be accepted.

Loan Acceptance: When the borrower’s loan gets 100% funds, the borrower needs to accept the T&C of the loan. The app can charge a fee while transferring money to your account.

Repayment: The borrower needs to do repayment as per the decided instalments and time duration.

For Lenders

Sign-up: Moneylenders need to sign-up just like the borrowers.

Account Chosen: Choose the type of account among a growth account, gradual income account, or a self-select account.

Funds Addition: After choosing the type of account, you need to add funds to your account, by different payment methods available.

Lend to borrowers: Lend the money to the borrowers after analyzing his credibility and deciding the bid.

Repayment: You will receive the repayment from the borrower as per the mutual consent agreement.

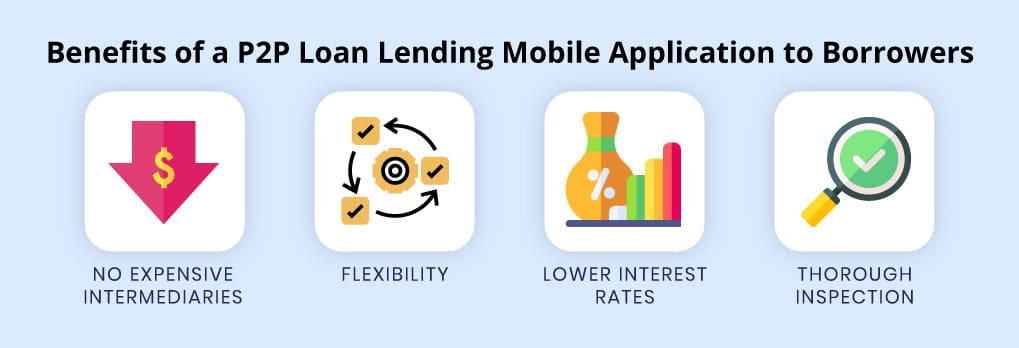

Benefits of a P2P Loan Lending Mobile Application:

To Borrowers

As above-mentioned, there are no banks, agents, or any other intermediary involved in a P2P Loan Lending app. Henceforth, the borrower doesn’t need to pay for these banking services. In fact, all the processes are carried out on a mobile application.

Flexibility

In P2P app loans, the borrowers don’t need to submit any collateral or asset as security like in the traditional loans. Also, the process of loan is quite fast and uncomplicated. Thus, the borrower gets access to funds in a shorter duration.

Lower Interest Rates

The interest rates are quite less on the P2P app because it works on the lowest interest bid by the moneylender. As the investors are lending their money directly to the borrowers through an application platform, there are no intermediaries, by which both parties can leverage from more favourable rates.

Thorough Inspection

While there are no requirements of the collateral, the borrowers need to submit multiple government identification copies. They also have to submit documents to prove their solvency.

To Lenders

Better Returns

The current average return rate on a P2P mobile app is 10%. However, it may vary as per the type of loan and duration. In the current market scenario, 10% return is still quite attractive.

Lenders Choose

As a money lender, you can delve into the complete details of the borrower and can check whether he is credible for getting the loan or not. You will also get the borrower’s credit score by which you can easily match your preferences.

Fraud Prevention

A money lender is investing money on your app with the trust of getting his money back. For this, a P2P mobile app implements a Fraud Prevention System to maintain a zero-tolerance policy for any fraud mechanism.

Why invest in a P2P Loan Lending Mobile Application?

The loan lending industry has evolved a lot. The current P2P lending market valuation worldwide was $67.93 billion in 2019 and is estimated to reach the valuation of $550 billion by 2027. The CAGR rate would be 30% from 2020 to 2027.

Things to consider while developing a P2P Loan Lending App:

Legalities

A P2P loan app would be regulated as per the country’s government rules and regulations to ensure all the entities work as per the rule.

Banking Partners

While there is no involvement of a bank, you would be requiring a banking partner who can take care of the financial activities.

Borrower’s Verification

You need to have a reliable method of verifying the borrowers on your application so that there should be no chances of fraudulent activities. You can implement:

- Government Identity Proof

- Income Tax Verification Proof

- Tax Return Proof

- Bank Account Details

- Phone Number Verification

- Passport Verification

Risk Calculation and Setting Interest Rates:

You need to use an advanced algorithm for pricing loans. For getting a loan, the borrowers must have:

- FICO Score of at least 600

- Maximum 40% debt-to-income ratio

- Credit Profile with any delinquencies

- Minimum one open bank account

GDPR and CCPA Compliance

These compliances provide basic rights to the users such as the right to information, access, rectification, erasure, restrict processing, data portability, object, and rights related to automated decision making and profiling.

Interactive UI & UX

Regardless of how many features, and security you gave a user on an app. The users would use it if it has an interactive UX and captivating UI.

Common Features

Loan/EMI Calculator

There should be a Loan/EMI Calculator to carry out all the necessary calculations involved in the loan process by entering the tenure, loan amount, interest etc.

Document Scanner

A document scanner would be required to upload the files regarding proofs, documents etc in the Portable Document Format (PDF).

Lead Management

The money lenders would be able to manage the leads who have borrowed their money. They can also track them and go through details like tenure, next payment, balance etc.

KYC/AML Automated Verification

KYC stands for Know Your Customer and AML stands for Anti-money Laundering. These verifications prevent the activities of generating income through illegal actions and give the complete details of the user.

Refinance Management

Refinance feature means when the borrower has paid half the loan, the borrower can refinance from other lenders for the loan based on his profile.

Credit Score

A credit score would determine how much loan you owed, length of the credit history, account types, etc.

Repay Options

There should be different types of repay options which can suit both borrower and money lender.

In-app Camera, Call and Chat

These three C’s are necessary for any mobile application nowadays. A camera would be required for uploading images of the documents, while call and chat feature can connect the lenders to borrowers.

Chat-bot Support

To make your app different from others you should include the trending customer care service like Chatbots which can resolve any queries arising for the features and functionalities by the users.

Read about: Personal Finance App Development: Costs, Key Features and Factors to Consider

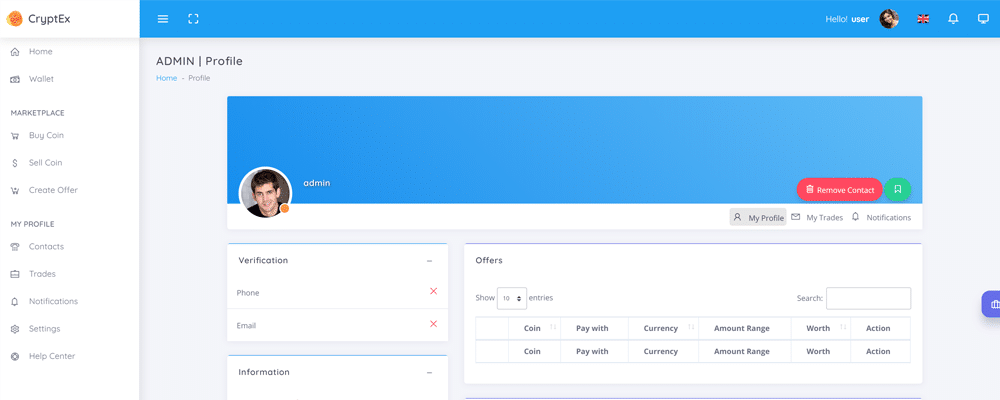

Admin Specific Features

Money Lenders Management

This will help the lenders in investing money by choosing the borrowers of their choice. They can also go through the details like amount required, loan tenure, and KYC profile.

Borrowers Management

Similar to the above point, borrowers’ management helps in submitting details like KYC, e-sign, and other information. The borrower also needs to upload documents, credit history, business, and other related information to get loans.

Push Notifications

Push notifications are necessary to retain your users on the application by which they can receive timely notifications. It will increase user engagement, conversion rates, and target more audience.

KYC Approval

When the user will submit the documents, the admin needs to check them and verify them for the KYC approval. The admin will approve the KYC if all the documents are correct.

Bank Partner Management

You will require an effective banking system to manage all the bank related policies, transactions, and other issues.

Read more: How To Create A Money Lending App: A Comprehensive Guide

Wrapping Up

Whether you want to develop an app for Android or iOS or React Native, we are having expertise in developing custom fintech mobile applications as per your demands.